PipeIntel

Powered by Tex-Isle Inc.

How frequently data is being updated?

All individual tickers under Steel Manufacturing, Pipe Manufacturing, and Mining Companies are updated every hour. All spot prices as well as the Index under Raw Materials gets updated daily by 9:30 am CT. For Transportation, BADI and ULSD gets updated daily by 9:30 am CT, All Grades gets updated every week by Tuesday 9:30 am CT, Truck Transportation updates by the end of first week of each month, and lastly, Cass Freight updates by day 15 of each month. All futures data for spot prices and ULSD in Transportation are updated once every day by 9:30 am CT. Index charts for Pipe Manufacturing, Steel Manufacturing and Mining Companies are updated every hour. Transportation Index reflects the trend of BADI, ULSD, and All Grades. Cass Freight and Truck Transportation are excluded from Transportation Index as the monthly update frequency would not accurately reflect the trend in daily Transportation markets. All curated articles and curated tweets with calculated relevance are updated once every day from 9:30 am CT.

How are Indexes calculated?

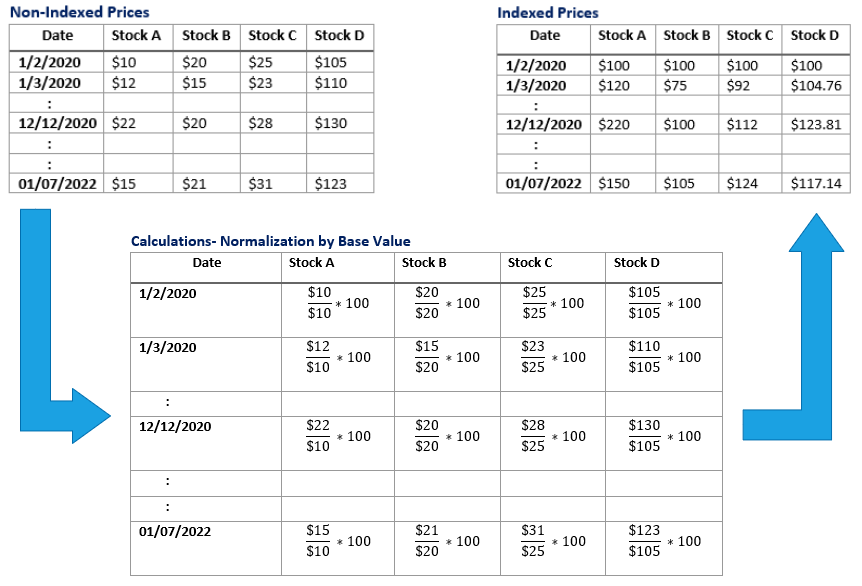

The index calculations apply to Raw Materials, Steel Manufacturing, Pipe Manufacturing, and Mining Companies. Currently, the described index calculations are not applicable to the Transportation Market. Before index calculations, to avoid bias and high variability between tickers with higher values and tickers with lower values, all tickers are normalized using common start value approach. The base value was established using pricing data from January 2, 2020. The start value was calculated by using the pricing data from January 2, 2020 which was divided by itself and then multiplied by 100. Therefore, all tickers have common start price of $100 on January 2, 2020. After the initial value, all other subsequent values are normalized according to the starting price (divided by base value and multiplied by 100). This ensures every percentage change in indexed values remains same as percentage change in non indexed values. See Table below for example.

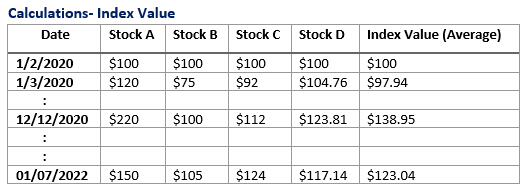

After all individual tickers or spot prices in the categories are normalized using the method above, the indexed values are used for index calculations. The index for each category is calculated using price-weighted approach, similar to the Dow Jones Industrial Average Index (DJIA). When DJIA was first introduced in 1890s, it was calculated using simply average of all stocks in index*. Similarly, here all index calculations are calculated daily using simple average of all indexed stock or spot prices. The approach will remain same until there is any quantifiable change affecting the divisor. The quantifiable changes may include but not limited to addition of a ticker, removal of a ticker, stock splits, or company merger.

*Seth, S. (2022, February 1). What the Dow Means and How It Is Calculated. Investopedia.